Crane Kenney Explains Disparity Between Cubs’ Revenue, Payroll

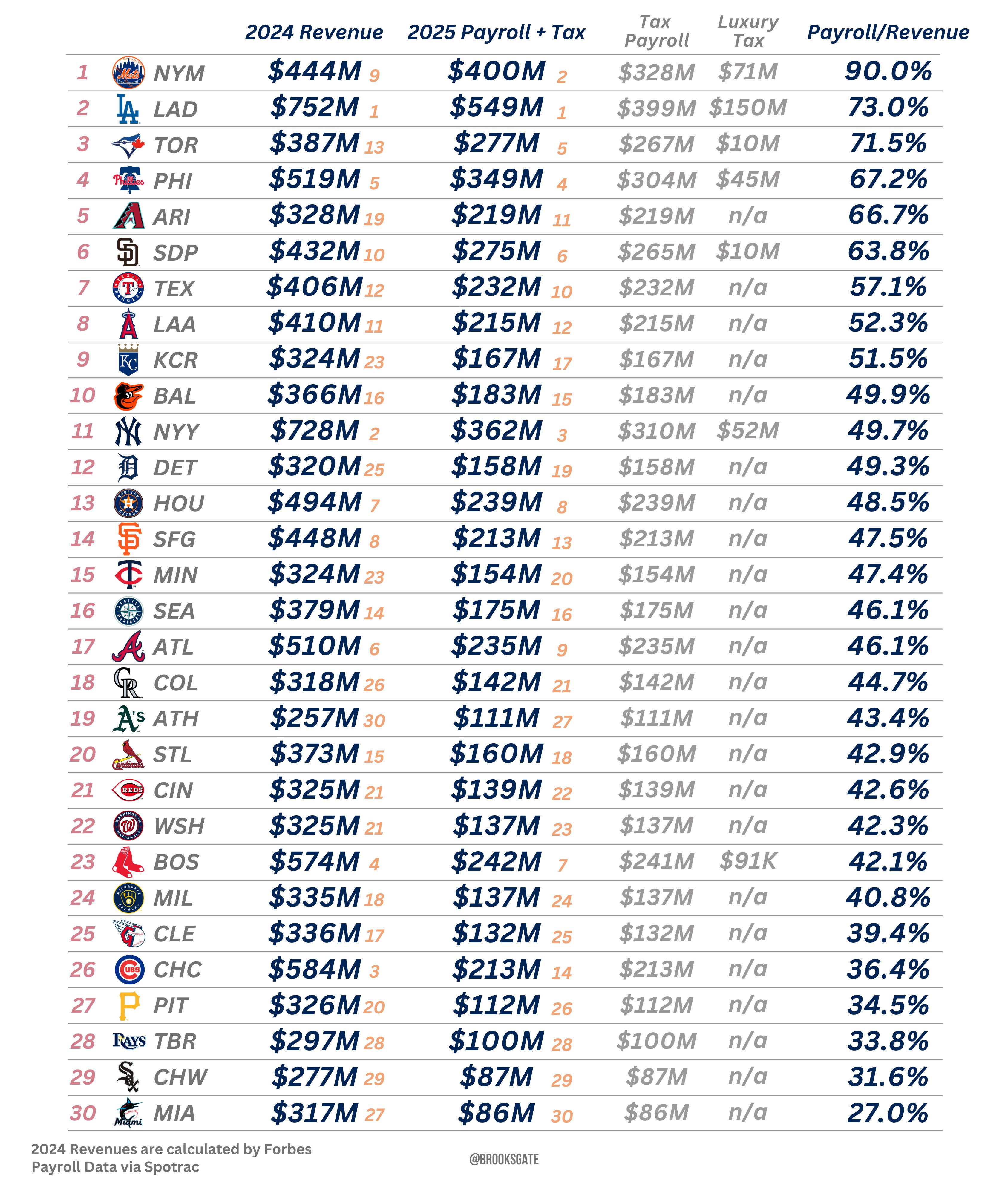

Much has been made about the Cubs having MLB’s third-highest revenue and just the 14th-highest player payroll, a disparity that angered many fans throughout the season. Then there’s that oft-cited BrooksGate graphic showing that the Cubs ranked 26th in terms of the percentage of their reported gross revenue dedicated to payroll last season (36.4%). They fell right between Cleveland and Pittsburgh, teams that generated roughly $250 million less than the North Siders.

This topic has gained steam in light of the recent announcement that Marquee Sports Network has let several employees go in light of financial issues with its digital offerings. Between that and the prospect of a work stoppage in 2027 creating another wave of biblical losses, there is plenty of reason to believe ownership will keep the purse strings relatively tight this winter.

As though drawn by a beacon in the sky, Cubs president of business operations Crane Kenney swooped in like Captain Save a Hoe to defend the club’s spending. Kenny joined David Haugh and Bruce Levine on Saturday morning on 670 The Score’s Inside the Clubhouse (30:40 mark) to explain the intricacies of the Cubs’ financial situation and how those gross revenue numbers aren’t nearly as big as they seem to us Philistines.

“Let me just say it’s really hard to compare one team to another — I mean, I’ll get into it as much as you want — but I don’t pay a lot of attention to it. There are so many factors, even within the same market, that are different. Let’s just start — the revenue line that I see most often is pre-revenue sharing. You guys know how revenue sharing works, but not everybody does. Every team gives about 48% of their revenue to the league, large markets and small, and then the league returns to each of the 30 teams an equal amount.

“So if you’re a large market, you obviously get back less than you put in, and you are a net payor. If you’re a small market, you get back a lot more than you put in, and you’re a net payee. And we’re one of the largest payors in baseball, so when you see the gross revenue line, that’s before revenue-sharing.”

If you listen really closely, you can hear the opening strains of a string quartet playing a score meant to induce a sense of melancholy. The volume grows as Kenny’s sermon turns to the numerous ways in which the very cathedral in which the Cubs play serves as a financial burden not borne by over 80% of the rest of the league.

“And even within a market, things are different based on how you own your ballpark. We’re one of five teams that own their stadium, so we wouldn’t trade for anything the honor of owning Wrigley Field, but with it comes the obligation to maintain it. Another example in the White Sox; they rent their ballpark and the landlord pays the majority of CapEx (capital expenditures). And these are huge numbers. Put it this way: Our CapEx for ’26 will be more than our highest-paid player.

So, again, would trade anything for the privilege of running Wrigley Field, but what we have to do to maintain our facility versus being in a rented facility is a substantial sum of money. The same thing is true with property taxes. So if you own your stadium, you get the honor of paying property taxes. If you’re in a leased ballpark, like the White Sox, you don’t. And that’s also a huge number.”

He conveniently glossed over the part about how Wrigley’s status as a federal landmark creates tax breaks, and how being a tourist destination yields as many visitors on off days as some ballparks get on a weekday game against a meh opponent. Then there’s the fact that they’ve got a whole-ass sportsbook affixed to the ballpark, complete with a 10-year, $100 million DraftKings sponsorship.

But who can blame him for leaving some of those details out, especially when the evidence he’s presenting is so convincing? And since I’m certainly not privy to the actual numbers, I’ve got no choice but to nod along and raise my hand with a hearty “Amen!” as the music crescendoes to match Kenny’s fervent tale of the team’s woeful tax situation.

“And then amusement taxes differ from market to market. So Chicago pays the highest amusement taxes in the country, no surprise with the way our taxes work here, at 12%, and we paid the most amusement taxes of all teams in baseball last year. LA, Boston, San Francisco, all those markets: 0% amusement or sales tax on their tickets.

“I’m not saying one is right and one is wrong, I’m just saying when you look at gross revenue numbers — before revenue-sharing, before CapEx, before property taxes, before amusement, all that — you’re not really seeing a real picture about what’s available to put into your baseball budget. Yeah, I’ve seen them. It’d be like me saying, ‘Hey, David, what was your gross income and what is your biggest expense?’ Let’s call it your mortgage. ‘Boy, you’re really rich.’ And you’re gonna say, ‘Yeah, but you’ve ignored all of my other expenses and my taxes.’

“So, you know, it’s fodder, it’s interesting to talk about, but it’s wildly inaccurate, so we don’t spend a ton of time looking at it.”

Hallelujah…Holy shit! That truly was as close to a religious experience as you’re going to find this side of Joel Osteen or Dr. Eli Gemstone. Which is not to indicate that Kenny’s pulpit is unconsecrated in any way or that his message was very carefully tailored to present the Cubs’ business operations in as good a light as possible. Except, yeah, that’s pretty much exactly what I’m indicating.

Look, I do understand that the Cubs face some unique circumstances and that their gross revenue is something of a mirage when it comes to how much money they actually have. But I have a very hard time believing they can’t afford to carry a top-five payroll in the sport, especially when the timing appears to be perfect for a big push to improve upon their 92-win season and NLDS exit.

What it comes down to is that this is Kenny’s job. He’s paid quite well to run the Cubs’ business operations, and, while I have frequently disagreed with much of what they’ve done in that regard, there’s a reason he’s held this role for so long. The Ricketts family very clearly approves of what he’s doing and how he’s doing it, which is all that really matters. As for how the rest of the congregation feels about his message, well, that may differ a wee bit.